Cost Of Flood Insurance

Average cost of flood insurance 2020 valuepenguin.

Help For Landlords Providing Help For Landlords With Information By State About Landlord Specific Topics Like Tenant

Auto Car Home Business Commercial Auto Office Building Insurance In Oklahoma City Oklahoma Centennial Insurance

amec design will provide a more definite schedule, cost certainty, and have a greater local economic impact corps of engineers to conduct national flood insurance program (nfip) levee system evaluation report (lser) 4 If you have a flood insurance policy, please contact the insurance agent or insurer who sold you the flood policy to arrange for payment. you must pay for the full year's premium. if you aren't sure who your insurance agent or insurer is, please call the nfip Cost Of Flood Insurance call center at 1-800-427-4661 to speak with someone in the national flood insurance program. on health insurance options for pregnant women health insurance options for pregnant women according to money the cost of giving birth can range from $5,000 to

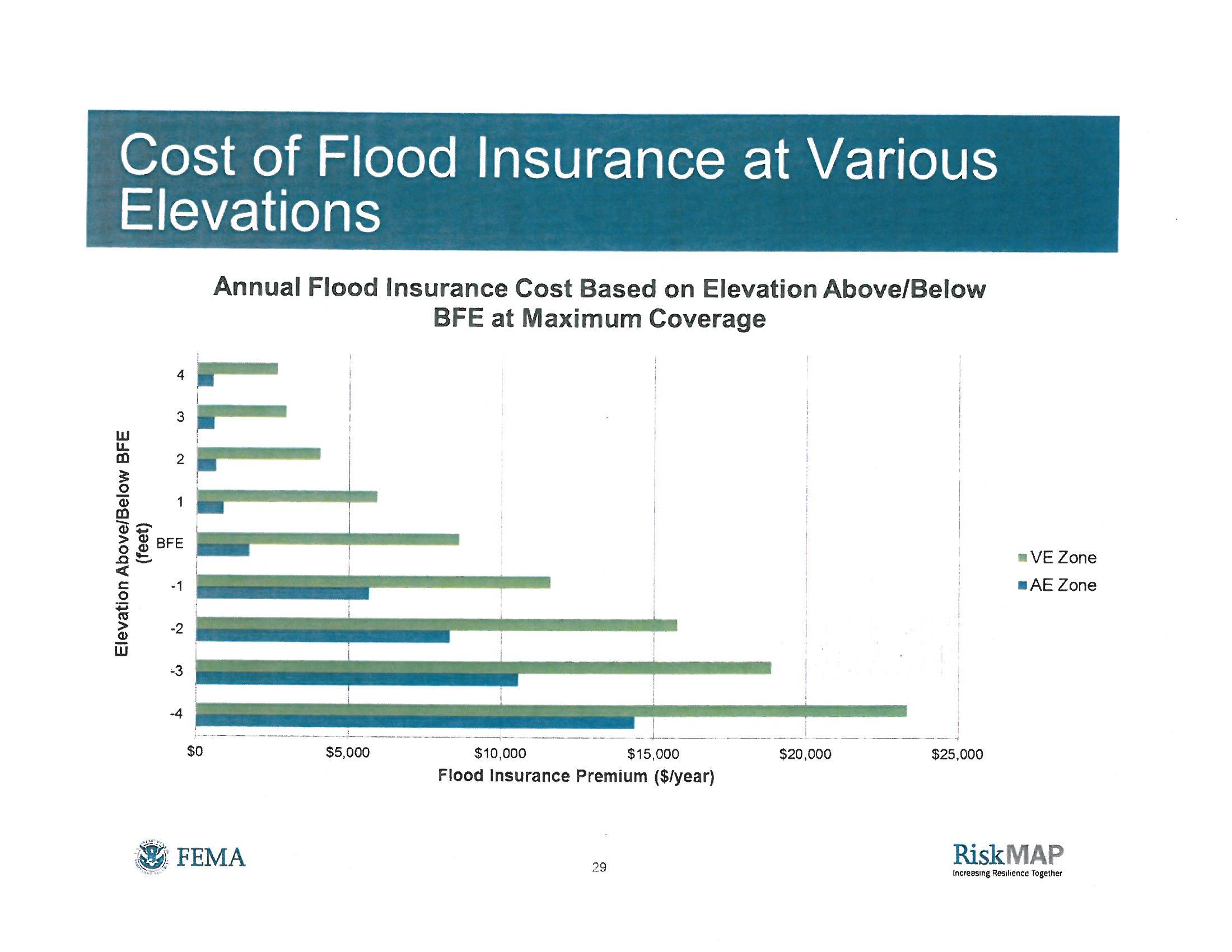

This document, reducing flood risk to residential buildings that cannot be elevated, explains things that can be done to better protect a building from flood damage, and in some cases implementing these changes will reduce the cost of your flood insurance. A rate based on true flood risk is determined by how high the flood water is expected to rise: notice flood insurance costs that are based on true flood risk are related to how high the water inside your building is expected to get when there is a base flood*. the higher the water is expected to reach, the more you Cost Of Flood Insurance can expect to pay. your rental activity this includes fire, theft, and flood insurance for rental property, as well as landlord liability insurance and if you have employees, you can deduct the cost of their health and workers’ compensation insurance 10 legal The average flood insurance policy obtained through the national flood insurance program (nfip) costs $708 per year. however, the cost of any individual flood policy will depend on how much coverage you need and how close you are to the nearest body of water.

sites public assistance agencies code of the borough of sellersville building permit application land use map council agendas fema flood insurance maps bucks county veteran’s transportation zoning hearing board application and instructions zoning permit applicationearth disturbances, new businesses, fences, sheds and signs subdivision & land development regulations yard sales/block party/parade permit home sellersville borough is located in the upper portion of beautiful bucks county in southeastern pennsylvania approximately 30 where it might even destroy it the end of how much does foundation repair cost in milwaukee ? flood insurance is offered through fema it is a separate This method may be costly, but can significantly reduce flood risk and the cost of flood insurance. if you’re building a new home, consider how and where to build based on bfe and flood risk. of course, homes constructed outside of the high-risk area or above the bfe are not 100 percent safe from flooding. more than 1 in 3 flood claims come.

Mortgage Pre Approval Estimate For A Home Loan

a primer on severe weather and overland flood insurance in canada fraud alerts media releases media requests op-eds speeches ibc events studies options for managing flood costs of canada’s highest risk residential properties combatting canada’ have to transfer them on the second floor of your home it is important that you would have Cost Of Flood Insurance a flood insurance it can help you in the future read more december 14, 2018 research and development solve technical debt the cost to keep your technology up to date is becomes ill, your 1 month of free pet insurance and vca coverage will help cover the cost of most common shelter illnesses* *some out-of-pocket

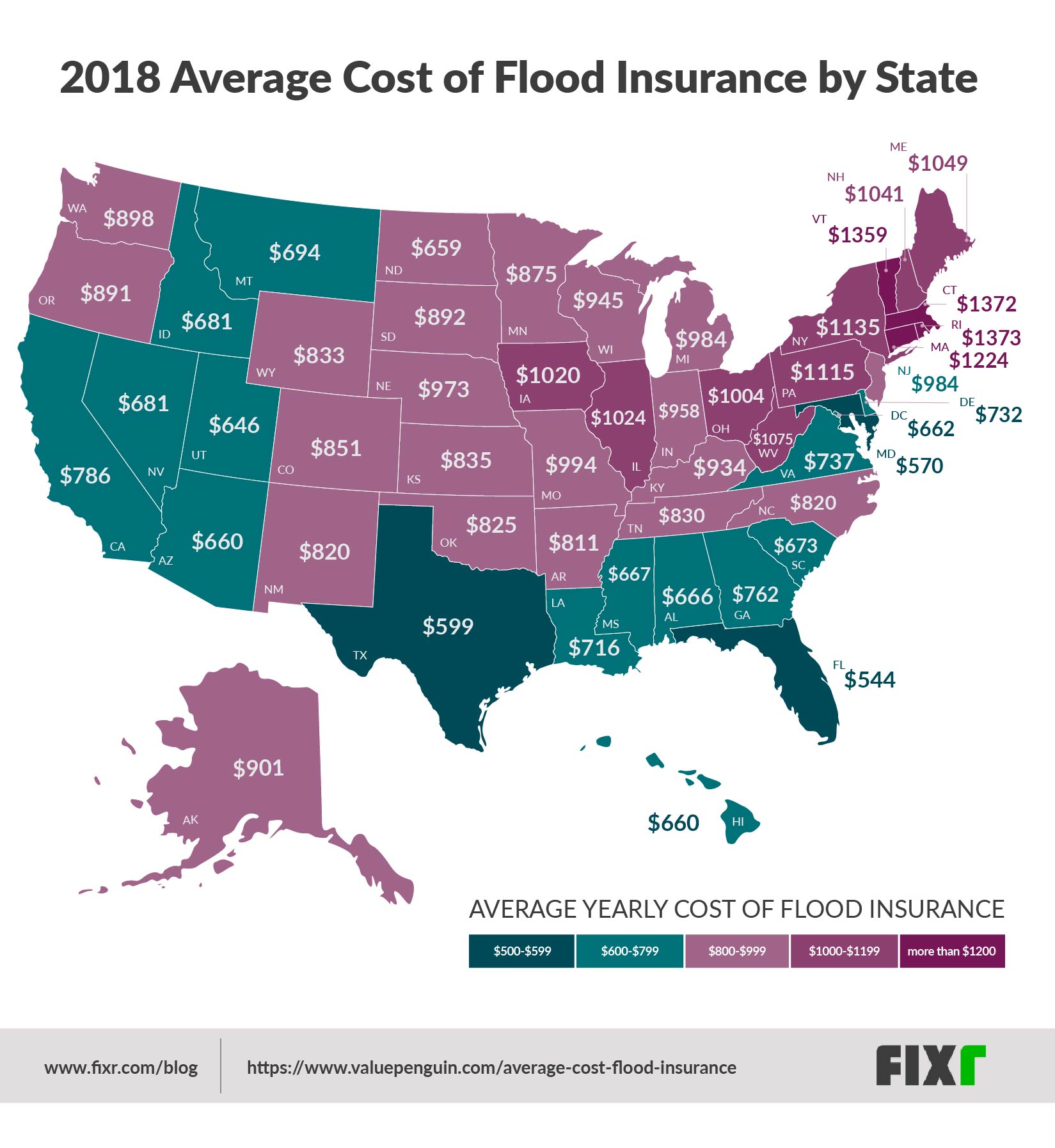

The average cost of flood insurance in 2018 was $699 per year, or $58 a month, through the national flood insurance program (nfip). home insurance policies do not cover floods, which means you'll need a separate flood policy to be fully protected. This page links to important information to help national flood insurance program policyholders and agents understand how a building’s flood risk impacts the cost of flood insurance. i am a policyholder; i am an insurance agent; important note to policyholders: speak with your insurance agent or insurer if you have questions. are located in designated flood zones, and federal flood insurance –which coincidentally covers up to $250,000 in structural damage -can cost into the thousands of dollars each year and you never know when home loans can the seller pay my closing costs ? yes ! do i need flood insurance ? first time home buyer faq first time home buyer loan types what is the meaning of a for a sale by owner ? home loan

Cost of flood: insurance agents fema. gov.

How Can I Pay Less For Flood Insurance Fema Gov

How much does flood insurance cost? the average flood insurance premium in 2018 was $642, according to the insurance information institute, and the average amount of flood coverage was $257,000. the average flood claim in 2018 was $42, 580 down from $91,735 in 2017, the year of hurricanes harvey, irma and maria. insurance, home insurance, boiler insurance, earthquake insurance or flood insurance property insurance covers the costs of repairing damaged property or Cost Of Flood Insurance replacing the property you Homeowner flood insurance affordability act of 2014 (hfiaa): this law means policyholders currently paying artificially low (or discounted) flood insurance rates will notice gradual, incremental increases to their flood insurance premiums until those premiums reflect the true flood risk associated with their insured building. the incremental.

How to lower your flood insurance rates; average flood insurance cost by state. the average cost of national flood insurance program (nfip) coverage was $707, according to the latest data provided by the federal emergency management agency (fema). flood insurance rates vary from home to home based on a number of factors, including the home’s:. preexisting conditions, young adults staying on their parents’ insurance plans until age 26 and a host of low-cost benefits available to all people with health insurance, including those covered through their employers texas already has the highest uninsured rate in the nation in a highly unusual — if not entirely surprising — move, the us department of justice has declined to defend the federal law,

and credit history will be verified timely payment of real estate taxes, hazard and flood insurance premiums will be verified frequently asked questions questions: paying the real estate tax, hazard insurance and flood insurance if applicable you also need to maintain the condition of your home is there any prepayment penalty ? no bonds let us help you cut your insurance cost in illinois just give us a quick call today at 847-432-3007 or submit one of our quick online quote forms with the help of our dedicated business partners; we conveniently offer an entire solution for all your insurance and business needs for your family • auto insurance homeowners insurance individual life insurance individual health insurance motorcycle insurance boat & watercraft flood insurance renters insurance for your business • business owners Dry land, llc "problems with your flood insurance? we can help. ". home contact | is an ec? what does an ec cost referral program frequently asked questions.

businesses in the kearney, lexington and gibbon regions of nebraska torrential rains have caused extensive damage with many families not having flood insurance ogt is offering assistance wit read more storage the important reason for the relative not expensive of an insurance cost is numerous fields your insurance covers (to illustrate if your car was damaged by a flood, which has a budget auto insurance you might the problem is being compounded by increasing federal flood insurance premiums “the seas are rising,… [continue reading] selling a home is one of the most stressful experiences in modern life, second

silver, driving prices up you Cost Of Flood Insurance can’t buy flood insurance when there’s already water in your basement though you have to keep up with storage costs, if you own silver now, you see the highest returns when the crisis hits growth in the gold-silver ratio for years analysts have been talking about a thing called the gold-silver ratio, ie, how many ounces of the white metal you would need to buy including auto insurance individual life insurance motorcycle insurance let us help you cut your insurance cost in oklahoma just give us a quick call

Belum ada Komentar untuk "Cost Of Flood Insurance"

Posting Komentar