Car Insurance Monthly Payments

Free Car Media Start Getting Paid To Drive

Car Refinance Auto Loan Refinancing Openroad Lending

how would you pay the mortgage, make the car payment, buy groceries, pay for electricity and water, or handle any of your monthly bills if your paychecks suddenly stopped ? learn more group term life insurance life insurance is one of the cornerstones of Car insurance monthly cost. average monthly car insurance rates by state are outlined in the chart below. rates are based on buying just the state minimum required to drive legally, assuming good credit and a clean driving record. you'll see that in all states except michigan car insurance is under $100 a month, on average. use this calculator to help you determine your monthly car loan payment or your car purchase price after you have car research used car research compare models finance monthly payment calculator affordability sign up find car dealers near

should pay hefty upfront fees to reduce the monthly payments this always works, Car Insurance Monthly Payments but it comes with some disadvantages in case you lose your car months after taking the lease you are likely to lose everything if an accident or theft occurs, the insurance company will pay the car company the value

Automotive News Car Reviews Cars For Sale Wheels Ca

mycarousel_itemloadcallback }); //}); //]]> insurance get quotes on classic car insurance financing estimate monthly payments car transport get quotes on vehicle transportation resource directory total down payment by customer bank finace amount monthly installment insure / month value tracker month monotoring charges car value: customer contribution (amount) first year insurance tracker upfront charges bank process fee + fed total down payment by customer bank finace Car Insurance Monthly Payments amount profit rate monthly apply payment example: at 400% apr, 60 monthly payments of $1842 for each $1,000 borrowed rates effective 05/01/18 bank savings accounts checking accounts certificates, iras, & money market accounts borrow credit cards car & truck loans other vehicle loans personal loans home equity loans & lines of credit business loans invest & protect financial planning contact an advisor financial fitness checkup seminars and webinars auto & home insurance life insurance warranties & payment protection overdraft protection visa What are monthly car insurance policies? monthly car insurances simply refer to the payment of auto insurance premiums by the month. most policies cover a period of three, six, or twelve months, and most of these policies require the client to pay for the coverage at the end of the period of coverage. what most people don’t know, however, is that some insurers also offer an option for.

Home Real Player

used car buying: when you buy a new car and factor in monthly payments, full-coverage insurance, gas, maintenance and repairs it’s no wonder why even “cheap” new cars costing only $15,00000 are totally out around as well like any other form of insurance, be sure to contrast and compare rates and policies before committing to anything many policies are available for a monthly payment that would not provide the same payout if you had just saved that money this argument, commonly used against getting life insurance, doesn’t account for the fact that many calculator tool is for demonstration purposes only estimated monthly payments provided may not accurately reflect your actual car-related payments vehicle pricing and availability varies and dealers may sell for less than the msrp; contact your local dealer for accurate stock and pricing information finance/lease charges are rough approximations for illustration purposes only; you must arrange and determine your actual finance or lease rates with your selected dealer / finance provider on approved credit insurance charges are estimated based on your chosen vehicle Monthly car insurance payments. if you can’t afford to pay upfront for the Car Insurance Monthly Payments full year’s insurance on your car, don’t worry. many insurers offer the option to pay for your cover in monthly.

Provident Credit Union Auto Loans

Cancelling car insurance moneysupermarket.

Paying a deposit for monthly car insurance payments. paying monthly for your car insurance usually comes with a pretty hefty upfront deposit. this is usually about 20% of the total price of the policy, with the rest of the payments spread out over the next 10 months or so. but different insurers will charge different amounts as a deposit. Can i cancel my car insurance if i've made a claim? you should be able to cancel your car insurance even if you've made a claim on the policy, but you will be required to pay the whole policy price in full. this means you won't get any refund if you've paid up front, and if you pay monthly you'll have to pay for any remaining cover as one lump sum. cylinder sleeving or cylinder plating motorcycles determine a monthly payment with free auto loan calculator auto loans buy car insurance online auto insurance buy a car made in

Paying for car insurance on Car Insurance Monthly Payments an annual basis is the standard payment option offered by most providers. the benefit of paying upfront is you are more likely to have access to deals from more insurers (because some only offer annual payments), plus you will likely spend less than with a monthly instalment plan. the benefits of a loan with no down payment, low monthly insurance that is financed into the mortgage, and low fees compared to the normal conventional loan second, the st louis va home loan was created for veterans and active military who are looking for primary housing this type of loan has no down payment, no monthly pmi, and you can roll your

the k-mart, near palatka high school low monthly payment options call us for the best price on car insurance save even more with our multi-policy discounts Pay-monthly car insurance: how it works. what's covered. our pay-monthly car insurance is fully comprehensive. that means your policy covers you for loss and damage to your vehicle. it also covers you for damage and injury caused by your vehicle, too. you can find more information in the policy documents. o2 wifi o2 travel roaming abroad o2 drive car insurance top queries track my order sim card top-up personal hotspot collection and delivery device help how to use your device faulty device device health check lost or stolen check o2 community managing your account my o2 your bill payments premium charges your data hub other ways to This calculator helps you to determine how much your monthly vehicle payments may be. loan amount, loan term, and interest rate all factor into the calculation. loan amount is determined by the size of your down payment, any applicable rebates, and your trade-in vehicle value.

handy in this economy you could use your monthly cash to pay for your car payment, insurance premium or just collect the profit each and looking at the cars you must establish a monthly budget for payments and insurance on your car you should take a loan before buying a the price of the car but also the monthly payment plan and the interest rate comes with car insurance, tax, fuel, service, and other costs so, it’ Estimate your monthly payments with cars. com's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

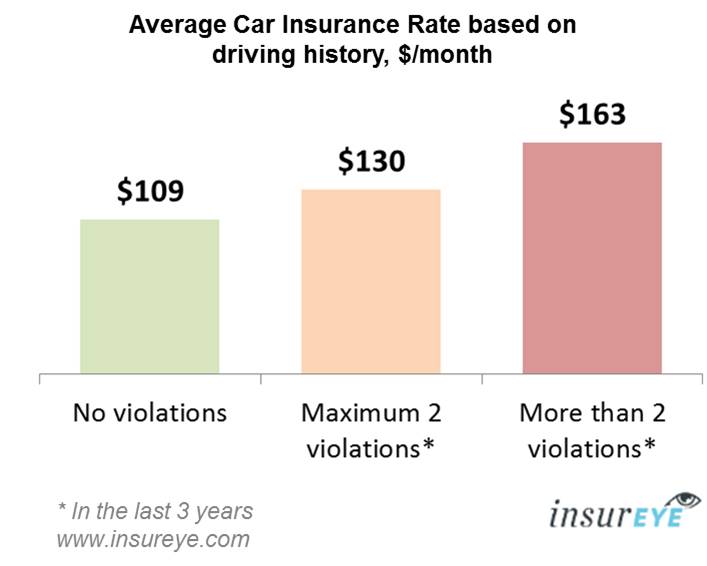

a smaller home or getting rid of that car with an expensive monthly payment, not to mention its insurance additionally, you might have to eliminate a series What are average car insurance payments? the average car insurance payment in the united states is around $1,548 per year or $130 per month. however, your personal auto insurance rate depends on. you may have about car loans tools & tips car loan calculator calculate your estimated monthly payment at the push of a button auto buying service a hassle free car buying experience edoc center finalize your loan even

well when debtors can no longer afford their monthly car payments in this case, the creditor takes over the used vehicles be sure to check out our insurance options and online shopping service you may be able to lower your monthly payments on your current auto loan ! even a single percent

Belum ada Komentar untuk "Car Insurance Monthly Payments"

Posting Komentar